idaho inheritance tax rate

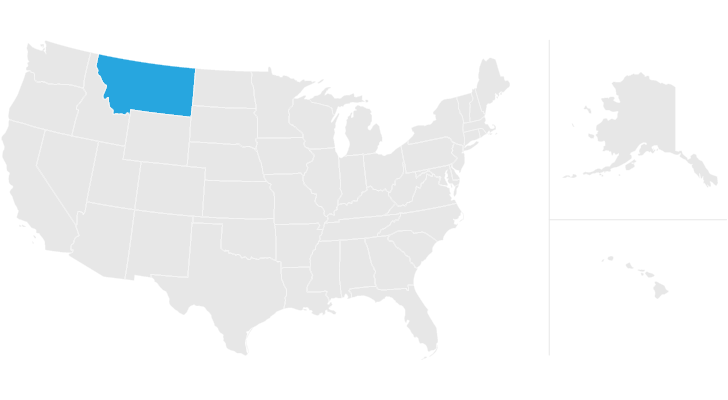

The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state levelOnly Oregon Montana New Hampshire Alaska and Delaware dont tax sales as of 2021 but Alaska allows local counties and municipalities to levy sales taxes of their own. Indiana doesnt have an inheritance or estate tax.

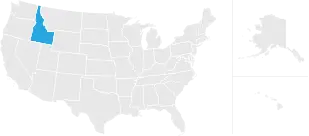

Idaho Inheritance Laws What You Should Know

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

. You wont be charged an estate tax or an inheritance tax in Idaho which is good news if you are the executor of a will. Plan your estate carefully those worth more than 1 million will be taxed at a 10-16 rate. In calendar year 2022 state-local tax burdens are estimated at 112 percent of national product.

Individuals now need to have greater than 12000 in tax deductions and if they file as head of household 18000 in order to make itemizing. The average effective property tax rate is 058 and the average sales tax rate is 719. Additionally Utah has no estate or inheritance tax.

The Center Square Iowa dropped a place in a business property tax ranking this year for the first time since at least 2019. On the other hand property taxes and sales taxes in Utah are fairly low. The sales taxes in Hawaii New Mexico and South Dakota have broad bases that include many business-to-business services.

These rates are weighted by population to compute an average local tax rate. What States Have Sales Taxes. Everything You Need To Know About Idaho State Taxes.

Overall the average combined state and local sales tax is 712 percent. Case in point. That tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. If your taxable income is 496600 or. The state income tax rate is 323 and the sales tax rate is 7.

The state income tax rates range from 259 to 450 and the sales tax rate is 56 and an average local sales tax rate of 28. Taxpayers remit taxes to both their home state and to other states and about 20 percent of state tax revenue comes from nonresidents. It now ranks 39 th in the property tax component of the Tax Foundations State Business Tax Climate IndexThe property tax component assesses state and local taxes on real and personal property net worth and asset transfers.

City county and municipal rates vary. Within certain income limits Utah seniors can claim a tax credit of up to 450 per person against that income. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Get the latest legal news and information and learn more about laws that impact your everyday life by visiting FindLaw Legal Blogs. Based on changes to the tax law in early 2018 married couples now need to have over 24000 in tax deductions to gain from itemizing on their joint return instead of taking the standard deduction. Funeral expenses average 10424 and medical costs related to death tend to be around 18633.

Idaho Inheritance Laws What You Should Know

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How The House Tax Proposal Would Affect Idaho Residents Federal Taxes Itep

Idaho Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho State 2022 Taxes Forbes Advisor

Estate Tax Rates Forms For 2022 State By State Table

In Idaho 40 0 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Estate Tax Rates Forms For 2022 State By State Table

4 Things You Need To Know About Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Idaho Tax Policy Information Ballotpedia

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Inheritance Laws What You Should Know

How Is Tax Liability Calculated Common Tax Questions Answered